4850Views 0Comments

Navigating the World of Fintech: The Intersection of Technology and Financial Services

Modern finance is shaped by technology and data. Payments happen in seconds. Banking works through apps. Investment decisions rely on data. Fintech rises from this shift, redefining financial services. India’s fintech adoption rate is around 87 percent, significantly above the global average of about 64-67 percent. (source : chambers.com). This growth boosts demand for fintech career opportunities.

What Is Fintech and Why Traditional Finance Is Changing

Fintech refers to the use of technology to deliver financial services in faster, smarter, and more accessible ways. Traditional banking relied on manual processes and physical infrastructure. Fintech replaces these systems with automation, analytics, and digital platforms.

It streamlines processes and builds user confidence. Digital lending speeds up approvals drastically. (source : Linkedin). Mobile wallets and UPI systems handle billions of transactions every month. These numbers show how deeply fintech influences daily financial behavior and why fintech career opportunities continue to expand across roles and industries.

Traditional finance institutions, once cautious about digital change, now partner actively with fintech startups. Banks integrate APIs. Insurance firms use chatbots. Credit agencies adopt AI. Adapting to this shift is key to staying relevant.

The Role of Technology in Modern Finance

Technology now drives decision making in finance. Banks, NBFCs, and fintech firms invest heavily in analytics and automation. Over 60 percent of financial institutions plan increased spending on digital infrastructure.

Several financial technology trends shape this transformation. Data analytics improves credit assessment. Cloud technology helps businesses grow without limits. Cybersecurity keeps your financial data safe and secure. You need both theory and hands-on skills to build a strong fintech career.

Fintech helps more people access financial services. Rural users now access micro-loans and insurance through digital platforms. Smart algorithms guide new investors with ease. Machine learning powers robo-advisory systems. New roles like data strategist and compliance analyst didn’t exist five years ago.

Key Fintech Trends Reshaping the Industry

Artificial Intelligence and Advanced Analytics

Artificial intelligence in fintech enhances fraud detection, customer personalization, and risk modeling. AI-driven systems help reduce fraud significantly. You gain value when you understand how data supports predictive finance and automation.

Finance professionals now interpret AI insights, not just numbers. Applied AI skills boost your role in credit and compliance.

Secure and Transparent Finance

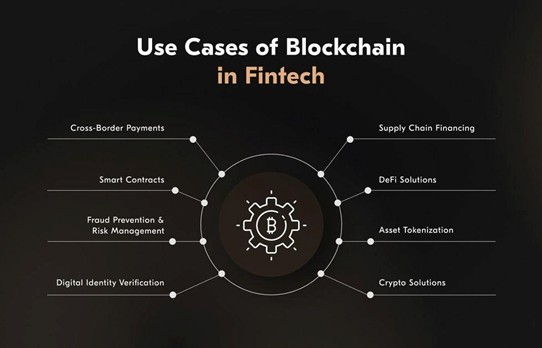

Blockchain in financial services enables secure record keeping and faster settlements. Banks test blockchain for trade finance and compliance systems. Demand grows for professionals who understand distributed ledger technology.

Source : https://autocruise.co.uk/

Blockchain’s impact reaches far beyond crypto. Smart contracts, supply chain finance, and KYC systems already rely on blockchain. Understanding these applications boosts your ability to contribute in modern finance teams.

Customer First Banking Models

Digital banking trends focus on paperless onboarding and mobile first services. More than 75 percent of banking interactions now occur through digital channels (source : economictimes.indiatimes.com). This shift creates opportunities in digital operations.

Source : web-and-mobile-development.medium.com

Banks now invest in customer analytics. As a professional, you interpret user behavior and improve financial journeys. Product managers and digital banking analysts now rank among top hiring roles.

Payments at the Core

Digital payment innovation is helping more Indians access financial services. UPI processes billions of transactions monthly. You study payment gateways, wallets, and cross border systems that support this.

Emerging technologies like NFC and biometric payments continue to evolve. Professionals with knowledge of regulatory compliance and transaction security stay in high demand.

How Finance Education Integrates Fintech Learning

You need education that blends finance fundamentals with technology exposure. Certifications and applied projects improve employability. Employers prefer candidates who understand compliance, analytics, and financial systems together.

Programs that include best fintech certifications help you build industry relevant skills. You also evaluate structured management programs that support long term growth through experiential learning.

Understanding fintech is no longer optional. It’s essential for meaningful roles in modern finance. Your learning must include hands-on exposure, industry-led sessions, and tools like Excel modeling, AI simulation, and blockchain case studies.

Fintech Learning at Vivekanand Business School

Vivekanand Business School integrates fintech into its PGDM in Banking and Finance through an industry aligned curriculum. The program follows a 15-month academic structure and a 9-month paid industry internship. This model offers exposure across banks, NBFCs, consulting firms, and fintech companies.

The specialization uses a seven module structure that covers corporate finance, investment analysis, portfolio management, derivatives, risk modeling, and financial technology. A five-day residential certification program at NISM provides hands-on exposure to securities markets and financial data analytics. Students also pursue NISM, IIBF, and commodity derivatives certifications.

Vivekanand Business School enhances learning through real-world exposure, supported by faculty with over 15 years of academic and industry experience. Their insights help students connect classroom concepts with the evolving financial sector.

Career Outcomes and Future Fintech Opportunities

Fintech hiring grows at over 20 percent annually. Roles include financial analyst, risk professional, digital banking manager, and fintech product specialist. You evaluate stability and growth when planning your future.

A structured program supports your career after PGDM in finance by building leadership and analytical capability. Graduates progress into strategic roles as experience increases. Fintech also opens global opportunities due to standardized digital systems.

Conclusion

You’re stepping into the future where finance meets technology. It transforms both financial systems and career paths. Strong fundamentals, technology exposure, and experiential learning support success. A focused management program prepares you in this tech-driven financial environment. Take the next step with Vivekanand Business School and build a fintech focused finance career today.

Author Bio,

Ms. Hetaal Palan is the Assistant Director – Branding, Marketing & Student Relations and Head – Alumni Relations at Vivekanand Business School (VBS), Mumbai. She leads strategic initiatives across institutional branding, student engagement, and alumni relations, playing a key role in strengthening VBS’s academic visibility and industry relevance. Her work focuses on aligning management education with evolving business, technology, and career trends.

LinkedIn: https://www.linkedin.com/in/hetaal-palan-00461737